charitable gift annuity tax deduction

When you donate you get a tax. An immediate income tax.

Chicago Zoological Society Gifts That Pay You Income

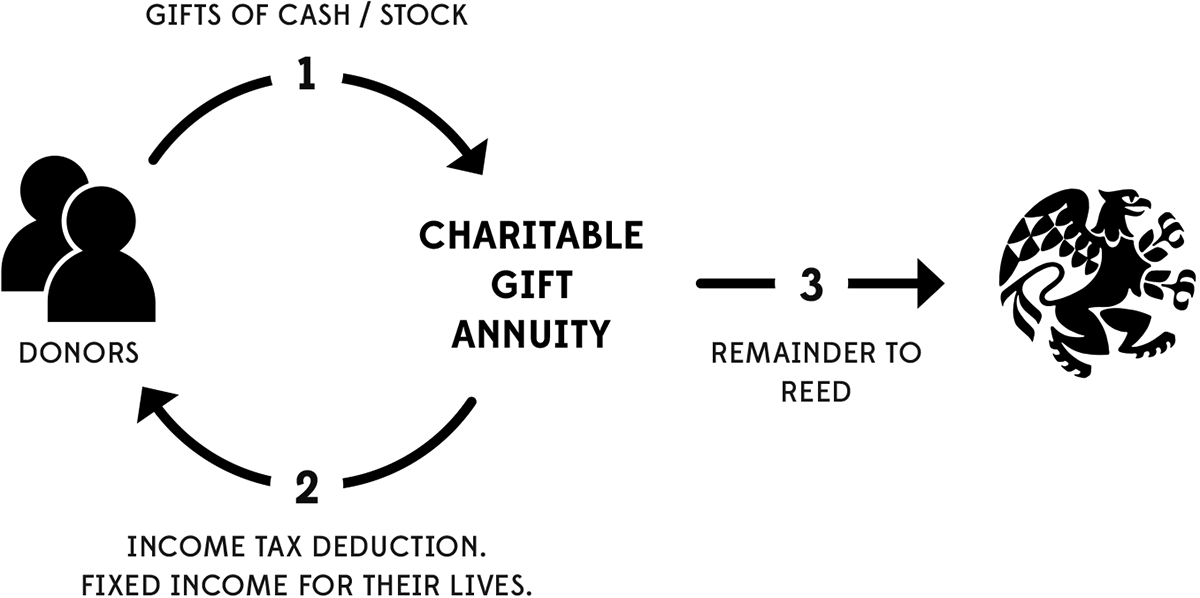

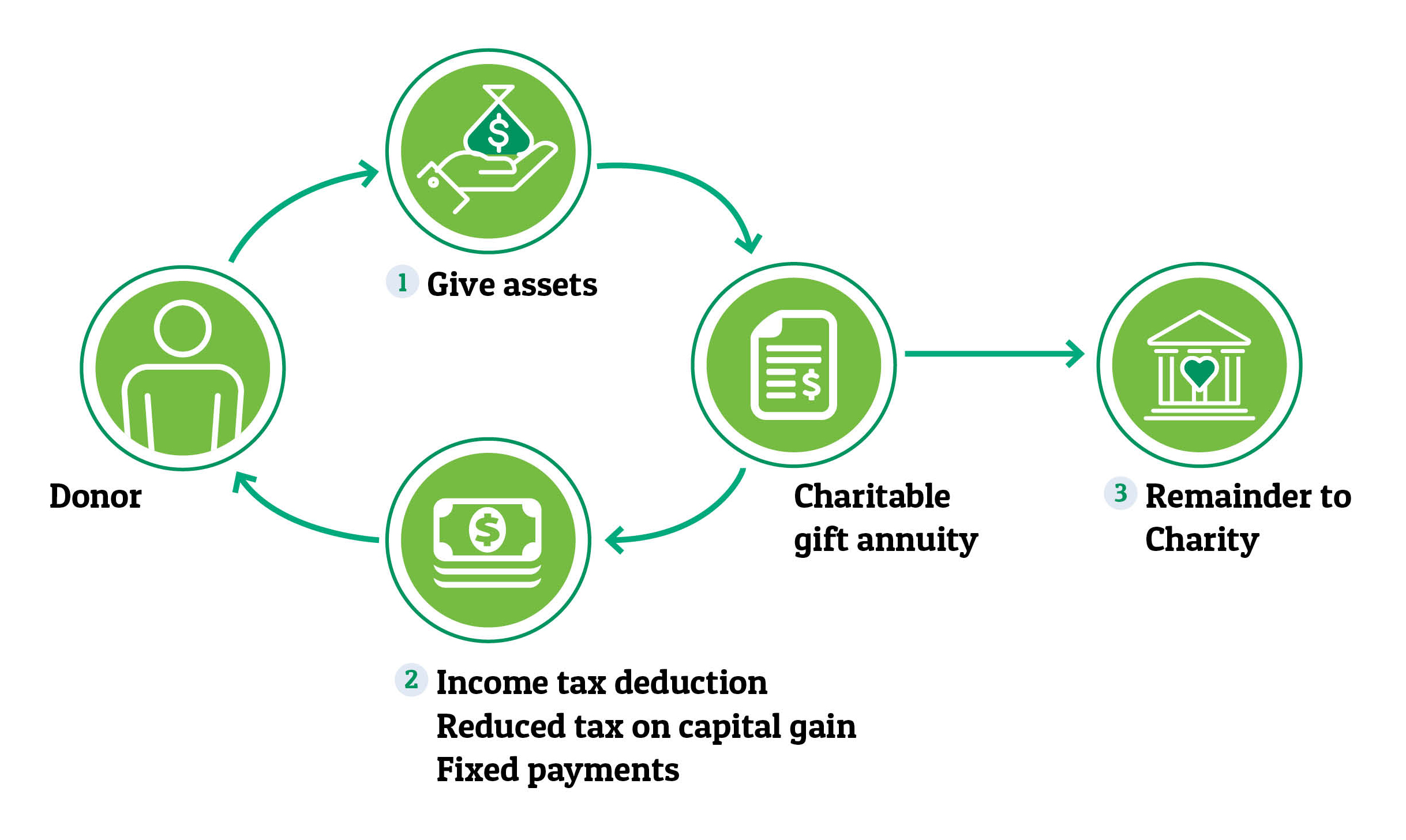

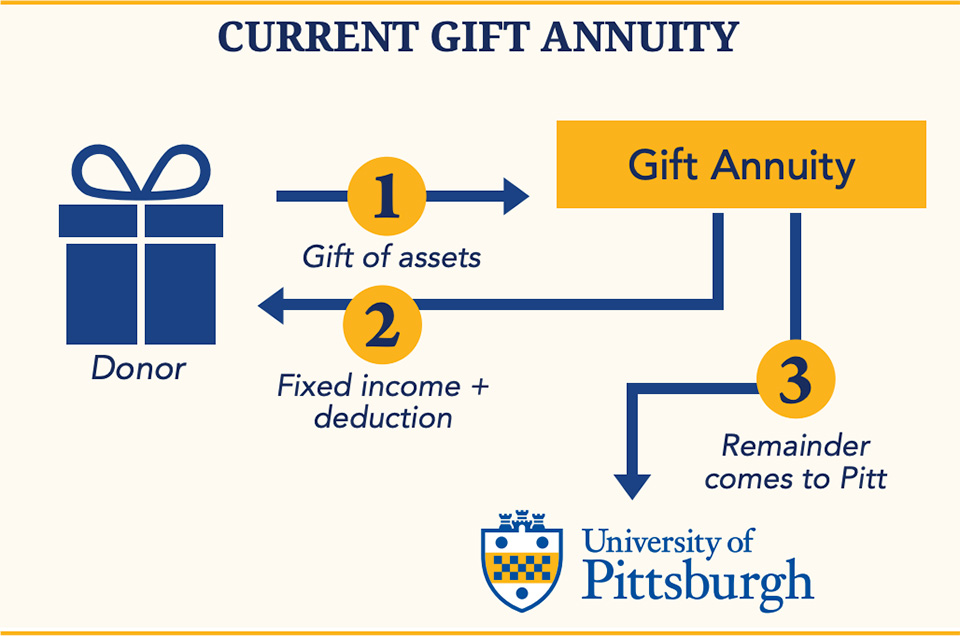

As a donor you make a sizable gift to charity using cash securities or possibly other assets.

. If you itemize your deductions a portion of the money donated in exchange for a gift annuity can be claimed as a federal income tax charitable deduction. It involves a contract between you the donor and Real Estate with Causes whereby the donor transfers. The minimum gift for setting up a charitable gift annuity may be as low as 5000 though it is usually much greater.

Charities must use the gift. If the gift annuity is funded with cash part of the payments will be taxed as ordinary income and part will be tax-free. If the annuity is funded with appreciated securities or real.

A gift annuity is deducted as a charitable donation a component of itemized deductions. A Charitable Gift Annuity is a donation that falls in the category of Planned Giving. You can fund a charitable gift annuity with an irrevocable donation of.

Best for maximizing tax impact with a delayed charitable gift. The minimum required gift for a charitable gift annuity is 10000. You have a charitable gift annuity that pays 500 per month based on a 5 rate of return.

A deferred gift annuity offers higher payment rates than current gift annuities and provides an immediate charitable income tax deduction often when the donor is still earning other income. As with any bargain sale the charitable deduction is simply the value of what the donor gave to the charity in this case cash worth 100000 less the value of what the donor received from. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated.

They fund a 25000 charitable gift annuity with appreciated stock that they originally purchased for 10000. Jones also desires to make a gift to her favorite charity. The annuity can make payments to up to two beneficiaries one of which is typically but not always the donor.

Generous standard deductions12950 for individuals and 25900 for married couples filing jointly in 2022. The donor makes a considerable gift to the charity via cash security or other. After the death of the second income beneficiary the charity receives the remaining value of the annuity.

Theyre also eligible for a federal income tax charitable deduction of 10217. You deduct charitable donations in the. It will pay her 800000 a year or 40 a year for the rest of her life.

The Charitable Gift Annuity Part Gift Part to Purchase an Annuity. A charitable gift annuity is a contract between a donor and a charity with the following terms. The donor also receives a partial tax deduction on the amount of the donation.

January 28 2020 659 AM. Charitable gift annuities have some tax advantages you cant get with other investments or methods of donation. She has 2000000 to invest in the annuity.

The charity sets the gift aside in a. The annuitant may also be eligible for a tax deduction based. A charitable gift annuity is a contract between a charity and a donor bound by some terms explained below.

Usually the minimum amount you can give to qualify for a charitable gift annuity is 5000 or 10000 but by and large the gift is much larger. That makes sense when you consider only part of the gift annuity is a gift to your. A charitable gift annuity is a contract between a charity and a donor where in exchange for an irrevocable transfer of assets to the charity the donor receives.

You use the IRS life expectancy tables to determine that the IRS expects you on. The annuitants monthly payment is. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments.

When a donor makes a contribution for a charitable gift annuity only part of the gift is tax deductible as a.

Charitable Gift Annuities The University Of Pittsburgh

City Of Hope Planned Giving Annuity

Abcs Of Cgas Basics Of Charitable Gift Annuities Gordon Fischer Law Firm

Charitable Gift Annuities Fidelity

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Less Is Often More Tax Issues With Charitable Gift Annuities

Give Receive Charitable Gift Annuities Thrivent Charitable Impact Investing

Charitable Gift Annuities Uses Selling Regulations

Gift Annuities Wheaton College Il

Gifts That Pay You Income The Salvation Army Western Territory Arc

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuities Suny Potsdam

Gifts That Pay You Back National Geographic Society

Charitable Gift Annuity National Gift Annuity Foundation

Planned Giving 101 Charitable Gift Annuities Agfinancial